The U.s. Census Bureau Defines a Family as

The nationwide moratorium on evictions – put in place most eleven months ago by the Centers for Illness Control and Prevention as an emergency measure – expired this past weekend, although President Joe Biden has proposed extending it. The end of the moratorium, which was intended to protect tenants who couldn't make their hire payments because of the COVID-19 pandemic, has alarmed tenant advocates, housing experts and others who fright that potentially millions of renters could be put out of their homes.

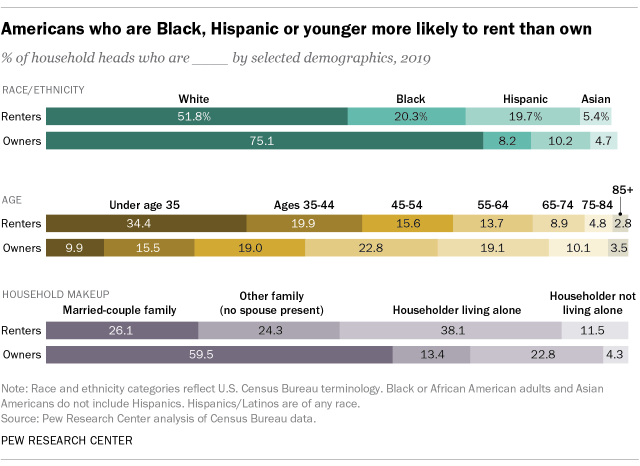

Renters headed virtually 36% of the nation's 122.8 1000000 households in 2019, the last year for which the Census Bureau has reliable estimates. Because sure demographics – immature people, racial and ethnic minorities, and those with lower incomes – are more probable to rent, those groups likely will exist unduly affected when evictions resume.

Pew Research Center consulted several data sources for this analysis of renters and landlords in the The states. The U.S. Census Bureau's American Community Survey provided the demographic characteristics of renters and homeowners (technically, households in renter-occupied and possessor-occupied housing units), too as information on rent paid as a percent of household income. The Federal Reserve's Survey of Consumer Finances provided additional data on renters, particularly on their income and wealth.

A separate Census product, the triennial Rental Housing Finance Survey (RHFS), provided information on ownership and management of rental properties, likewise equally overall numbers and size ranges. (The information is updated equally of 2018; a new RHFS is being conducted this year.) For purposes of analysis, we combined several forms of business organization (limited liability companies, limited and general partnerships, real manor investment trusts and corporations) into a broad category of "for-profit businesses."

The Internal Acquirement Service's Tax Statistics programme was an boosted source for data on individual owners of rental property and their finances. Individual investors typically study rental income and losses on Schedule E of Form 1040; nosotros examined aggregated Schedule E filings from 2003 to 2018, the about recent yr bachelor.

Race and ethnicity categories reflect U.S. Census Bureau terminology. In this analysis, Black or African American adults and Asian Americans do not include Hispanic/Latino adults, who may be of any race.

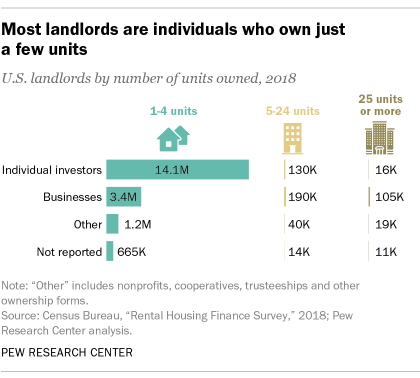

Merely setting policies to help renters in demand without hurting landlords is complicated. Landlords aren't a homogenous grouping of faceless corporations. In fact, fewer than one-fifth of rental properties are owned by for-profit businesses of any kind. Most rental properties – almost seven-in-ten – are owned by individuals, who typically own just one or two properties, co-ordinate to 2018 demography data. And landlords have complained nearly being unable to meettheirobligations, such every bit mortgage payments, property taxes and repair bills, considering of a falloff in hire payments.

I big disparity among renters is race and ethnicity. Nationwide, about 58% of households headed by Black or African American adults rent their homes, as do about 52% of Hispanic- or Latino-led households, according to Pew Research Heart'southward analysis of census information. By contrast, roughly a quarter of households led past non-Hispanic White adults (27.9%) are rentals, as are just under 40% of Asian-led households.

White, non-Hispanic householders account for three-quarters of all owner-occupied housing units in the United States, but just over half of all renter-occupied units.

Younger people – those below the age of 35 – are far more than probable to rent than are other age groups: About two-thirds (65.ix%) of this age group lives in rentals. This compares with, for example, 42% of those ages 35 to 44, and less than a third (31.v%) of 45- to 54-twelvemonth-olds.

Though renter-occupied households are almost evenly split between families (50.four%) and non-families (49.vi%), people living lonely business relationship for the biggest unmarried group of renters (38.1%, or most four-in-x). (The Census Agency defines a "family" equally any group of 2 or more people related by birth, matrimony or adoption who alive together.)

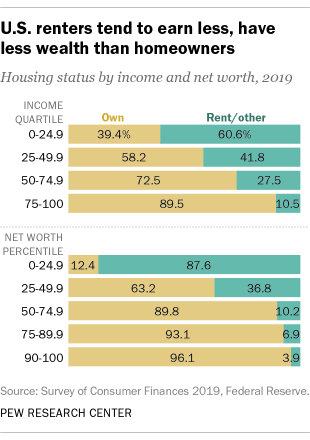

Renters skew to the lower ends of income and wealth distributions, according to data from the Federal Reserve's 2019 Survey of Consumer Finances. About three-fifths of people in the lowest income quartile (lx.6%) rent their homes, equally do 87.6% of people with internet worths below the 25th percentile. In both cases, as 1 goes up the income or internet worth distribution scale, the share of people who are renters falls: Only 10.v% of people in the top income quartile, for example, are renters.

If those are the renters, and then who are the landlords? The Census Bureau counted virtually xx one thousand thousand rental properties, with 48.2 million individual units, in its 2018 Rental Housing Finance Survey, the most recent one conducted. Individual investors owned nearly fourteen.iii one thousand thousand of those properties (71.vi%), comprising about 19.9 one thousand thousand units (41.ii%). For-profit businesses of various sorts owned three.seven one thousand thousand properties, or 18.8%, just their holdings totaled 21.7 meg units, or 45% of the total. Entities such as housing cooperative organizations and nonprofits owned smaller shares of the total.

Businesses own larger shares of units because individuals, while far more numerous, tend to own one or two properties at most, while businesses' holdings are larger. In fact, 72.5% of single-unit rental properties are owned by individuals, while 69.5% of properties with 25 or more than units are owned past for-profit businesses.

Most rental backdrop are endemic by individuals, but but a small share of individuals ain rental property, according to IRS income-tax data. In 2018, six.7% of private taxation filers (virtually 10.iii million) reported owning rental properties. Those filers reported owning i.72 properties on boilerplate.

There was a notable increase in both the number and share of individual filers reporting rental property during and after the 2007-08 mortgage crisis. In 2006, 8.three million tax returns (half dozen%) reported ownership of rental property. By 2014, that number had risen to nearly x.7 meg (seven.2%). One researcher at the Department of Housing and Urban Evolution (HUD) has suggested that those figures reflect a surge of individuals buying foreclosed homes on the cheap and renting them out.

Tax data on businesses that own rental property is harder to come by. Still, that aforementioned HUD researcher has estimated that there are fewer than one one thousand thousand "business entity" landlords, adding that they "likely own an boilerplate of more than twenty units, with many managing hundreds of units."

Individual landlords received $353.7 billion in rental income in 2018, which sounds like (and is) a lot of money. But as any businessperson knows, top-line revenue doesn't necessarily pb to bottom-line profit. Indeed, only nigh one-half of individual landlords reported internet income in 2018, with the rest losing money on their properties. Such losses tin, nether certain conditions, exist used to offset other taxable income.

Regardless of whether the landlord is making money, rent makes upwardly a big chunk of many tenants' expenses. Of the near 44.i million renter households in 2019, more than 45% paid rent equal to 30% or more of their gross household income (30% being a common dominion of pollex for how much of a person's gross income should be spent on housing). That's really downwardly from 2013, when near half (49.7%) of renter households were paying 30% or more in rent.

Source: https://www.pewresearch.org/fact-tank/2021/08/02/as-national-eviction-ban-expires-a-look-at-who-rents-and-who-owns-in-the-u-s/

Post a Comment for "The U.s. Census Bureau Defines a Family as"